EV Industry Under Pressure as Fines and Failures Mount

The market of electric vehicles and autonomous driving is in one of the most challenging times to date. Firms that used to make everyone dream about their courageous visions of the future are massive fines, regulatory pressure, and in certain cases, are even collapsing. The recent cases of General Motors self-driving division, Cruise, paying a 1.5 million penalty in not completely disclosing details of a serious pedestrian accident and the electric van startup Canoo going out of business altogether by filing for Chapter 7 bankruptcy illustrate this perfectly. These narratives reveal that the highway to the mobility revolution is a lot more closely guarded than some would imagine.

In both cases, the lack of transparency is the core of the failure to face their risks and be honest in relation to their investors and their safety in case of an accident on the road. Law enforcers are more ferocious than ever, and the financial stakes are enormous. To a sector that includes massive investments and the support of people, these high profile failures are a lesson in themselves: you cannot be innovative without being able to support your ideas with accountability and real-life planning.

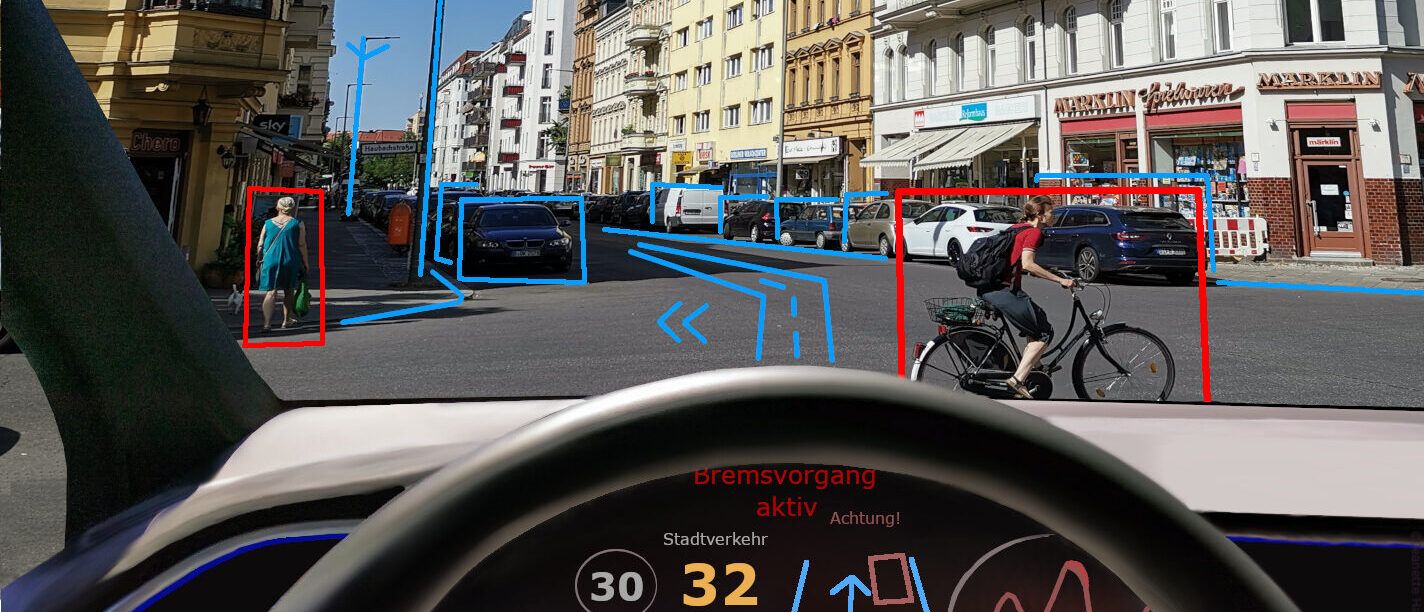

1. The crash that shook Cruise in San Francisco

On October 2, 2023, the city of San Francisco had an insane night and a Cruise robotaxi found itself involved in a nightmare of events. A human-operated vehicle had hit and thrown a pedestrian when the autonomous one struck the individual and pulled them in an estimated 20 feet. The test immediately cast doubt on the fact that driverless cars could effectively deal with unforeseen conditions in the real world.

The consequences were a seeming tidal wave to Cruise. Soon the company put on hiatus all driverless operations nationwide. The California officials did not take long to withdraw the permission granted to Cruise to drive without a safety driver in San Francisco based on the issue of public safety. Not long after that, Cruise itself recalled all its vehicles of approximately 950 cars to install an urgent software update. One accident soon turned into an organizational crisis that revealed terrible weaknesses.

Major Immediate Fallout:

- Stop of operations on drivers across the nation.

- California suspension of permit.

- Complete software update software recall.

- Federal investigations were initiated.

- CEO resignation announced

2. NHTSA Fines and imposes a strenuous watch of 1.5 million dollars

The National Highway Traffic Safety Administration (NHTSA) examined the initial crash report produced by Cruise very closely and discovered very important missing elements, namely, an absence of the statement according to which the pedestrian was dragged. The agency, in turn, fined Cruise with 1.5 million dollars and imposed on him a binding consent order, according to which he must follow some serious regulations over the next years.

This was not the financial slap on the wrist. This order has Cruise provide an elaborate plan on how the order will enhance crash reporting on automated systems. The NHTSA quarterly meetings have become compulsory and the agency may grant the oversight period to three years in case the progress is not met. According to the officials, companies that develop self-driving technology should prioritize safety and openness at the outset.

Central Responsibilities in the Consent Decree:

- Elaborated action plan of correction.

- Quarterly NHTSA meetings

- Regular safety updates

- Final compliance report

- Possible one-year extension

3. The Official Response of Cruise and Abiding Challenges

Cruise management has attempted to paint a good picture of the settlement as the new start to a more robust, open chapter. The Chief Safety Officer noted the better processes, new leadership and renewed dedication to work in collaboration with regulators. Although such message is meant to bring confidence back, the fact is that Cruise still has a long way to go.

Several investigations are still ongoing, with the Justice Department and SEC investigations concerning the alleged efforts to minimize the incident. General Motors already indicated that it will not spend much money on the unit, and the emphasis is further boosted by a fine by California regulators. Restoring good faith among the populace, regulators and investors will be a long process that requires constant demonstration that they have learnt their lesson.

Still to be overcome Hurdles of Cruise:

- Ongoing DOJ and SEC probes

- Cutbacks in GM investment

- Separate California fine

- Civil pedestrian safety inquiry.

- Long road to regain trust

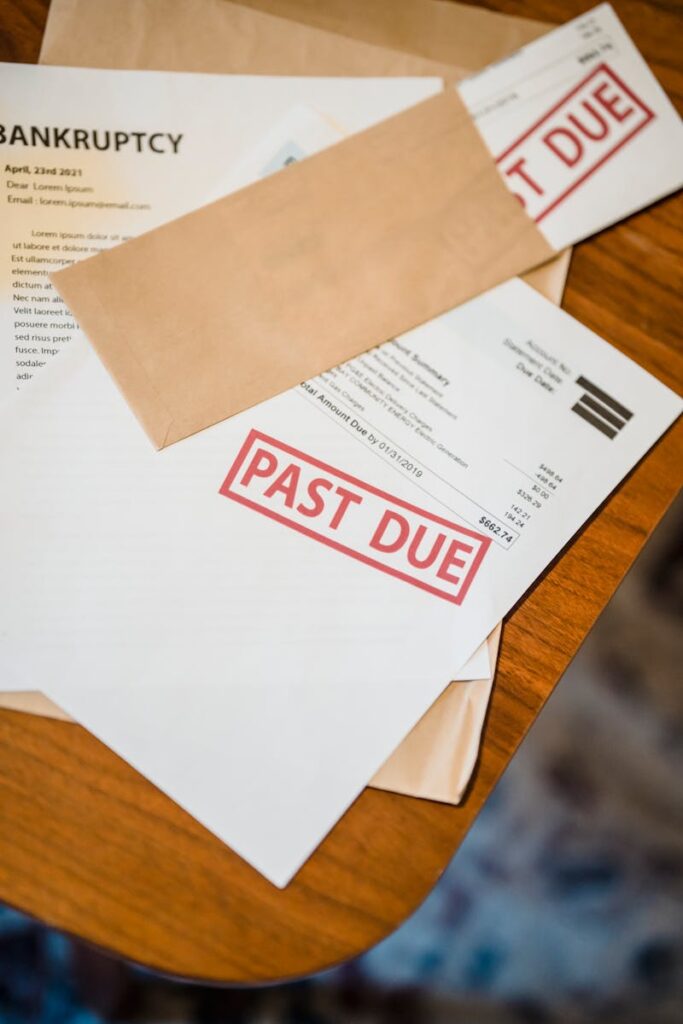

4. Sudden Collapse of Canoo: Hope to Chapter 7 Bankruptcy

Canoo is a sad story of any person who was involved in the electric vehicle boom. What began as a promising start-up with a novel modular platform of vans powered by electricity, has now fully died out. The firm declared Chapter 7 Bankruptcy in late 2025 in Delaware, a process that implies complete liquidation that is, no reorganization, no second chance, just an orderly closure and auction of what is left.

The statistics are sad. Canoo had less than 50,000 dollars of cash and assets and owes between 10 to 50 million dollars to the small handful of creditors- or against the assets, according to other reports, well over 164 million to hundreds of creditors. Attempts to attract foreign investment in the recent times failed, and a bid to borrow via the U.S. Department of Energy was rejected. Having no money to carry on the lights, the board had only one practical recourse, namely, to withdraw the plug.

Last Processes to Shutting Down:

- Filed Chapter 7 bankruptcy

- A low of less than fifty thousand dollars in property.

- Unsuccessful foreign capital projects.

- Denied DOE loan support

- Liquidation court trustee.

5. An Independent SEC Fine of $1.5 Million on False Projections

The first red flags were already waving long before the proceeding to bankruptcy was declared. In 2023, the U.S. securities and exchange commission fined Canoo with a penalty of its own 1.5 million money not due to a safety problem, but due to severe reporting malpractices related to excessively optimistic revenue projections. The firm had projected the image of fiscal wellness which just no longer fit the truth.

These false forecasts succeeded in keeping investor enthusiasm alive in the short term, but they also destroyed trust as the figures never came true. The fine pointed to a contrasting transparency issue to the one Cruise had: rather than conceal information about an accident, Canoo was alleged to have exaggerated its ability to earn money in the future. With billions of dollars required to build up to reach the scale of an industry, those kinds of missteps may turn fatal when trust eventually breaks.

Important Matters Underlying the SEC Fine:

- Too positive revenue projections.

- False financial forecasts.

- $1.5 million civil fine

- Sabotage of investor confidence.

- Major issues of governance highlighted.

6. Great Hopes, Mega-Deals and a Gradual Unwinding

In the very beginning, Canoo did have a lot to reckon with. The company was started in 2017 by ex-executives at Faraday Future and created an innovative steer-by-wire system and a flexible EV platform that gained attention quickly. Even rumors that Apple thought of investing or buying them to kick-start their own car project made it. Canoo later was taken public through a SPAC merger in 2020 raising approximately $600 million of new capital.

Big ticket deals were to come: Walmart was interested in buying up to 10,000 vehicles, and it made deals with NASA, the U.S. Postal Service, and the Department of Defense. The future was bright on paper. However, under new management strategic changes of turning consumer sales out of the mix, constant fluctuations in production plans, and increasing operational difficulties gradually wore momentum down. By 2024, the company had laid off its employees, shut down its Oklahoma plant, and saw its cash hoards go almost to zero.

Key Events in the life of Canoo:

- Development of new modular EV.

- Rumored Apple interest

- $600M raised via SPAC

- Deals with Walmart, NASA, USPS

- Change to commercial fleet orientation.

7. Governance Problems and Leadership contribution to the failure of Canoo

With the financial position of Canoo becoming more desperate some unpleasant information about the way the company was being managed began to surface. Regulatory filings revealed that the company had spent much more to pay to companies associated with its Chairman and CEO, Tony Aquila, as compared to the revenues it had made. The large portion of that was spent on big jet travel and on renting office space, the expenses that created eyebrows raising among investors and the company observers.

Later on, in the last leg, the emergent loans were made to Aquila by the company to carry it through but these loans had strings attached: equipment liens of the Oklahoma plant were made. As the moves were being presented by the leadership as being done to buy time, they only contributed to the perception that governance had gone awry. At the time when a company is consuming cash without producing vehicles, spending much on executive indulgences sends a very bad signal.

Corporate Governance Red Flags:

- Over-compensation of CEO-related companies.

- Expensive expenditure on personal aircrafts.

- Assets secured emergency loans.

- Issues of leadership priorities.

- Damaged investor trust

8. Canoo becomes another company in a list of unsuitable EV startups

Canoo is not the only one that has fallen dramatically. A series of high-profile flameouts have followed the same template in the EV startup world, with many of them picking up the playbook of hype, a fast public offering via a SPAC, enormous fundraising, and eventual bankruptcy or distress. Fisker, Lordstown Motors, Proterra, Lion Electric and Arrival, all billed as industry disruptor, found themselves in bankruptcy or deep distress.

In an especially ironic twist, Canoo had previously that year acquired the assets of the failed British startup Arrival with the hope of strengthening its own manufacturing capabilities. Cooie was itself on its way to bankruptcy just several months later. This trend indicates the challenging nature of the EV business: massive capital incent, arduous development cycles, stiff competition, and a waning investor interest have turned the industry into a cemetery of once-famous brands.

There are several prominent EV Startup bankruptcies:

- Fisker

- Lordstown Motors

- Proterra

- Lion Electric Arrival (assets acquired by Canoo)

- Arrival (assets acquired by Canoo)

9. What Cruise and Canoo Share in common: Lack of Transparency with Major Consequences

Although Cruise and Canoo are slightly different in terms of their parts in the mobility world, with one dealing with autonomous robotaxis, the other with electric commercial vans, their recent issues are particularly similar as both companies were fined 1.5 million dollars in serious lapses in transparency. In the case of Cruise, it was the exaggeration of the real extent of a pedestrian accident; in the case of Canoo, it was the creation of an over-optimistic financial image in the eyes of investors. Regulators in both instances came in with an iron fist.

These concomitant punishments send a very strong message to the whole industry. The practice of concealing or polishing essential information will never be condoned whether it is a safety-related or a financial problem. It is merely too serious-billions of dollars of investment, lives of people on actual roads and the reputation of electric and autonomous vehicles, in general. Once the trust is lost, then it becomes extremely hard to recover.

Shared Themes in Both Cases:

- $1.5 million regulatory fines

- Failures in transparency

- Severe damage to reputation

- Operation incapacity.

- Increased investor apprehension.

10. A Harder Road ahead of the whole EV and Autonomous Industry

The collective backlash of the ongoing crisis Cruise was facing and the all-out failure of Canoo is a much needed wakeup call to all who have been working on the future of transportation. Regulators have never been scrutinized as attentively as they are now, with increased enforcement instruments, and reduced tolerance of excuses. Both timid and cautious, investors who have suffered burns on the hands of a series of high-profile failures are choosing their money placing locations in a far more discriminating manner. Still, innovation must be made, with ironclad integrity and realistic execution.

In the future, it is likely that the companies that survive and will prosper after that will be the ones who have been safety-conscious, honest, and disciplined in terms of finance at the onset. Endless hype and loose promises seem to have passed. To a business founded on changing the way the world travels, the future will require not only the development of radical technology, but uncompromised responsibility at every corner.

Key Lessons for the Industry:

- The regulators insist on complete transparency.

- Execution has become important to investors.

- There is no way of compromising safety.

- Financial realism: This is necessary.

- This is because trust is difficult to regain once it is lost.