The Widening Wage Chasm: How UAW’s Historic Gains Reshape Auto Industry Compensation and Intensify the Battle for Tesla’s Workforce

American automotive manufacturing compensation is in a radical change, with the recent historic contract wins of the United Auto Workers (UAW) and their new frontier, the non-unionized operations of Tesla. The changes are not simply the movement of pay scales but the restructuring of the competitive nature of labor costs, executive compensation, and even the culture of work in a sector that is central to the transition of the global economy to electric vehicles.

The ability of the UAW to negotiate huge pay increases to its members at the Detroit Big Three of Ford, General Motors, and Jeep-maker Stellantis has rocked the industry. Although Tesla has recently introduced a pay raise to some of its factory employees, the examination of the new pay packages shows that unionized employees in the legacy car makers will still receive much higher hourly salaries, which will further increase the already significant disparity.

The new pay rules, which Tesla implemented on January 8, according to the internal documents examined by Business Insider, provide factory workers with a wage range of between $22 and $39 per hour. This change places the Tesla workers in a better position to earn wages aligned with the average wage of an auto factory worker in the industry, but the base pay remains significantly lower than the wages of UAW members, which is the basis of the aggressive organizing approach of the union.

To explain this gap, we can take the case of General Motors, where the rate of a production worker at the beginning of the year was 25.25 per hour and the maximum rate was 36.00 per hour at the end of the last year. According to the new contract of the UAW, the minimum hourly rate in GM will increase to 30.60 in September 2027, and the maximum will be 42.95. Ford and Stellantis have comparable wage rates, with their projections of the highest wages being over 42 per hour at the end of their respective four-year contracts.

In addition to base wages, UAW members also pay dues ranging between 0.8 to 1.1 percent of their gross monthly wages which are deposited in a strike and defense fund. This fund is a very important safety net, as it offers financial assistance to the workers in case the union decides to go on strike, which is a testimony to the collective bargaining strength that makes unionized labor.

The Expanded Mission of UAW and the Cultural Barriers of Tesla

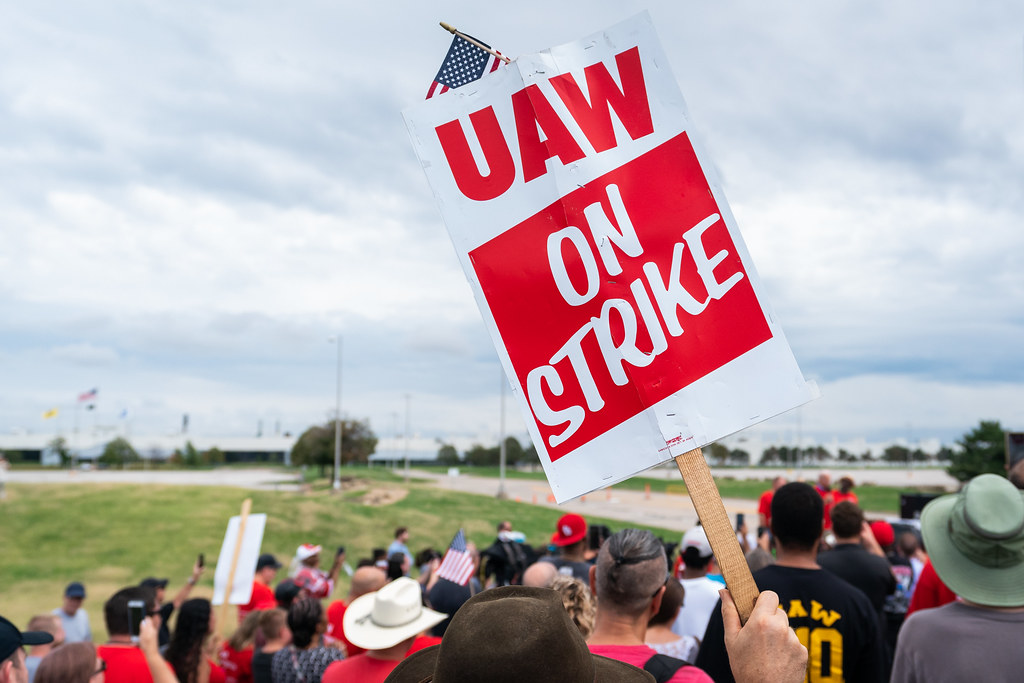

The victories of the UAW last year were the climax of a historic strike, which paid off with what UAW President Shawn Fain boasts as historic contracts. With these victories under its belt, the union is now firmly targeting Tesla, considering it the next strategic point in its mission to increase its presence and multiply its membership in the automotive industry. This motivation, however, has strong headwinds, caused by a mixture of the unique corporate culture in Tesla, the mood of some part of its employees, and the anti-union policy of the company, which has been well-documented.

Although the pay disparity is obvious, a portion of the Tesla employees has been unwilling to accept unionization. Anonymous to Business Insider in order to prevent the consequences that may arise at the workplace, a few employees expressed a core compatibility with the vision of CEO Elon Musk. To these employees, the chance to work on the innovative mission of Tesla seems to be more important than the chance of union wage increment.

Moreover, the financial gains of stock options in the long run are a special privilege to most long-term employees of Tesla. The share price increase of the company, which has shot up by 800 percent in the last five years, has earned millions of dollars to some of the employees, which provides a strong motivation to stay non-unionized. This economic benefit makes the conventional appeals by the UAW which focus only on wage increment difficult.

The employment policies of Tesla also contribute to the development of the predisposition of the workforce to the specific ethos of the company. A single employee who has gone through the hiring process commented that it is not a prerequisite to be a Tesla fanatic, but it can be influential. This implies that the company favors candidates who are likely to identify with the ambitious culture of the company that is fast-paced. In fact, in 2022 alone, the number of people who wanted to work at Tesla exceeded 3.6 million, which only confirms the popularity of the company regardless of its non-unionization.

The culture of start-up of Tesla, when Musk was urging factory employees to sleep on the line, is in a sharp contrast to the more organized and collectivist culture of unions. This ideological difference is a major obstacle to the UAW, and it requires a strategic solution that would not only focus on financial rewards but also cultural orientation.

The Anti-union Track record and Legal Battles of Musk

The hostile relationship between Elon Musk and labor unions and regulatory organizations is widely reported. Tesla and its CEO have been in constant conflict with the National Labor Relations Board (NLRB). In one striking example last year, the NLRB claimed that Tesla had fired dozens of workers in its Buffalo, New York, facility soon after workers had indicated that they were planning to unionize. This charge brings up the issue of possible employer retaliation against organizing activities.

More recently, in 2021, the NLRB determined Tesla and Musk had illegally threatened employees who tried to form unions in 2017. The board directed the company to reemploy a union-activist employee that Tesla had dismissed despite the company appealing the ruling. The NLRB also determined that Tesla also questioned workers who participated in the unionization process and ordered Musk to remove a tweet it considered an anti-union tweet, which is publicly available, which indicates continued disobedience.

These examples highlight a trend of opposition. Unlike other giant car manufacturers, Tesla has never had a union vote in any of its U.S. plants. But in a curious twist last year, the German union IG Metall announced that a portion of Tesla employees at the Brandenburg factory of the company had become members of its union, suggesting that union feeling is not completely non-existent in the international Tesla operations.

Musk, in his turn, has publicly invited the UAW to conduct a union election in Tesla, saying that he was sure that his employees would not vote in favor of unionization. He has claimed that ex-UAW members employed at Tesla are not enormous enthusiasts of UAW, which places this as an argument of his workers choosing non-union jobs. This is a bold challenge that underscores the stakes of any possible unionization drive.

The recent revival of the UAW and the aggressive leadership of Fain however indicate that a different result may be possible. Fain has categorically blamed the failure of the past in organizing non-union plants to internal union corruption, a too-cozy relationship with the management, and unfavorable contracts. Having the recent precedent of organizing large-scale strikes at GM, Ford, and Stellantis, Fain believes that the union has shown that it could successfully confront any corporation, including Tesla.

Pay Comparisons, CEO Compensations, and Labor Union Controversies

UAW President Shawn Fain recently admitted in a statement that Tesla has recently increased its pay, but it is not enough to satisfy the companies or the worth of autoworkers. This feeling is the gist of the argument of the union that despite the changes, the compensation package of Tesla, including the benefits, remains drastically lower than that of the UAW employees of the Detroit automakers. Before the recent 25% increase in four and a half years that UAW negotiated, the total compensation of Tesla workers was estimated at $45 an hour in wages and benefits, as compared to around 65 an hour in UAW workers.

The overall theme of the wage demands by the UAW against the Detroit Big Three has always been the dramatic rise in CEO compensation over the last four years. UAW President Shawn Fain has quoted a figure that implied a 40 percent rise in CEO pay, which is in stark contrast to the 6 percent pay increases autoworkers got since their 2019 contract. This gap led to the first demands of a similar 40 percent wage rise, as well as the reinstatement of pensions and cost-of-living increases, which were subsequently reduced to 36 percent but nevertheless led to a strike as a result of the continuing dispute.

The emphasis of CEO compensation by Fain is consistent with a trend of increasingly assertive labor unions that are expanding on the ability of the wealthy executive leadership to bridge the wealth disparity between the executive and the rank-and-file employees to support their demands of better pay and working conditions. This has been witnessed in other industries especially when the Writers Guild of America called on Netflix shareholders to vote against executive compensation packages in the midst of the Hollywood strike.

Nevertheless, executive compensation is notoriously difficult to calculate. An example is the General Motors CEO Mary Barra who challenged the 40% figure of the UAW saying, I do not know where the 40 percent figure came. The executive compensation usually includes a number of elements, the main ones being stock grants or stock options, the final value of which depends on the market performance and the stock options vesting schedules. An in-depth examination of the filings to the public by Equilar on behalf of The Associated Press shows a subtle image.

The only one among the three CEOs who have been in her position since 2019 is Mary Barra, whose total compensation was 28.98 million in 2022. The biggest part, which is 14.62 million, was stock grants that are vested after three years. In fact, her compensation has grown by 34 percent since 2019. In 2022, the compensation of Ford CEO James Farley was close to 21 million, a 21 percent more than the compensation of the previous CEO Jim Hackett in 2019, which was about 17.4 million. The package offered by Farley had the stock awards of $15.14 million that also had a three-year vesting term.

Stellantis Complexity and Extravagant Pay Differentiations

This is especially complex when it comes to Stellantis, which was established in 2021 as a result of the merger between Fiat Chrysler Automobiles and PSA Group. Stellantis being a European firm, executive pay disclosure is different compared to the U.S. firms. Its annual remuneration report reported the 2022 pay of CEO Carlos Tavares as 23.46 million euros, almost 77 percent higher than the 2019 pay of then Fiat Chrysler CEO Mike Manley of 13.28 million euros. These were the numbers that the UAW used to compute the collective 40.1% rise in CEO compensation in the three automakers since 2019.

Importantly, the figures of Stellantis represent the realized pay, including the value of equity that vested in the past and was previously granted. Conversely, the U.S. companies normally utilize the grant date value of the stock packages granted during the reporting year. In an equivalent comparison, Equilar, which applied the grant date method, estimated that in 2022, Tavares is compensated 21.95 million euros, including 10.9 million stock awards with a three-year vesting period. According to this, the compensation of Tavares was in fact a 24 percent decrease of the 29.04 million euros package of Manley in 2019.

This fall is however a deceptive one because in some years realized pay may actually mask significant compensation. An example is the 2021 compensation package of Tavares, which consisted of a special incentive award of 25 million euros in cash and 19.56 million euros in stock (subject to long-term performance targets) and was awarded due to his essential role in the merger. This award, which was one time, greatly boosted his 2021 compensation, way beyond what Manley earned in 2019. This pay proposal was only advisory but was voted down by Stellantis shareholders 52.1% and the board finally voted in favor of it. The compensation packages of the CEOs of GM and Ford also reached their highest point in 2021 and slightly decreased in 2022.

No matter how the executive compensation is computed, the gap between the compensation of the CEOs and the compensation of the rank-and-file employees at all three companies is enormous. In GM, with a median worker salary of $80,034 in 2022, a normal employee would need 362 years to earn the amount that Barra made each year. In Ford, where the median salary is $74,691, 281 years would be equivalent. In the case of Stellantis, 64,328 euros is the median compensation of workers, which is equal to 365 years to be paid the same as Tavares in 2022, but this ratio decreases to 298-1 without considering the one-time grant of Tavares.

These numbers are much higher than the average pay gap at S&P 500 companies, which was 186-1 in AP annual CEO pay survey. A study by the Economic Policy Institute shows that the ratio of CEO-to-worker compensation in the 350 largest publicly traded companies in the United States in 1965 was a paltry 15-1, which is astronomical when compared to the ratio today.

Labor Expenses, Pay Structure of Tesla and the Wealth of Musk

One of the most common arguments that automakers use is that their foreign rivals work with much lower labor costs. The labor professor at Cornell University, Harry Katz, observes that, with benefits, employees of the Detroit 3 auto companies earn about 60 an hour, and that wages at the auto companies based in other countries that have plants in the United States are between 40 and less $45. This price difference is an issue that is here to stay as the sector shifts towards electric cars.

The case of Tesla is an exception in the executive compensation debate. In 2022, Elon Musk, the CEO, officially reported a zero compensation in the company proxy statement, making its reported pay ratio meaningless. The reason is that Tesla has not given Musk new packages since a long-term compensation plan that could be worth more than 50 billion was granted to him in 2018 and is now subject to a legal challenge by shareholders. Nevertheless, the proxy statement provides an insight into the unbelievable wealth gap, with the total realized compensation of Musk in 2021 amounting to more than 737 million. Conversely, an average Tesla employee made 40,723 in the same year, which is equivalent to 18,000 years of the same worker to earn the same amount of money that Musk earned in 2021.

The open contempt of Elon Musk towards unions also makes the organizing of the UAW more difficult. During the New York Times Deal Book Summit, Musk said, “I do not agree with the concept of unions… I simply dislike anything that makes a lords and peasants type of thing. UAW President Shawn Fain took advantage of this comment, and he sarcastically said, the irony is that he is talking about lords and peasants and that is their present position. Fain emphasized the difference between the vast wealth of Musk and employees who are still struggling to make ends meet as he constructs rocket ships to launch his ass into space.

Musk has a track record of anti-union activities. In 2018, he posted a threat on Twitter that employees at the Fremont, California, plant of Tesla would lose stock options in case they joined a union, which a federal appeals court later found illegal. The NLRB has also decided that Tesla breached the labor law by limiting the Fremont workers to wear pro-union shirts and by trying to silence the talk about pay and grievances at an Orlando service center. These, among others, are examples of an aggressive stance towards unionization.

In one such confession, at the Deal book Summit, Musk said: “When Tesla gets unionized, it will be because we earned it and we did something wrong. This comment, though possibly not meant as such, sums up the arguments that the UAW is making that the exploitation of workers, humiliation, dismissal of those who complain, and stifling of federally guaranteed rights to negotiate working conditions are a core failure. The current conflict in Sweden, in which Musk has declined to negotiate a contract with a union representing Tesla mechanics, which has resulted in mass solidarity strikes by dockworkers, electricians and postal workers, is another example of his firm anti-union position on an international level. The leaders of the Scandinavian unions have come out to publicly criticize the up-your attitude of Musk and his perception that he can act outside the norms of their labor market.

A Labor and EV Future Defining Moment

The Tesla organizing campaign by the UAW and over a dozen other non-union car manufacturers is a watershed in the labor movement. The impact of collective action cannot be ignored as the union has already led to wage rise in the non-union industry such as Tesla due to the historic contract with the Big Three. However, the journey to unionizing Tesla is full of daunting obstacles, including the deeply rooted culture of the company, as well as the special financial incentives of its employees, up to the unrelenting and even legally challenged resistance of Elon Musk.

The struggle between labor costs, employee rights, and executive pay is bound to be more intense as the auto industry goes through the complicated process of switching to electric vehicles. The UAWs aggressive campaign at Tesla is not only about bridging a wage disparity, but it is a fundamental challenge to the future of labor relations in the most innovative industrial sector of the 21 st century. The result will not only determine the livelihoods of hundreds of thousands of autoworkers but also the overall economic balance of capital and labor in an ever more automated and globalized competitive environment. This continuing story with its complex financial facts and strong human narratives deserves close attention on all sides of the business world.

The Turning Point Ahead

With the struggle over wages, working conditions and corporate authority escalating, Tesla and the UAW are now at the forefront of a far greater change that is occurring in the entire auto industry. What started as a fight over hourly wages have become a classic challenge on how employees, businesses, and shareholders will maneuver the emergence of electric cars and the new economic conditions that they create.

The triumphs of the UAW at the Big Three have already changed the expectations way beyond Detroit, compelling non-union automakers to respond and reconsider their own pay systems. However, the culture of Tesla, its strong financial motivation of long-term employees, and Elon Musk long-standing resistance to organized labor make this task unlike anything the union has ever dealt with.

The next move will not only impact factory floors but will also determine how employees will be involved in the future of high-tech manufacturing, how businesses will balance innovation and fairness, and how the revolution of electric vehicles will treat people who make it. The stakes are massive, the tensions are tangible, and the result will be felt in the industry throughout the years.