America’s Affordable New Cars Are Quietly Going Extinct

Recall the previous time when you came across an advertisement of a genuinely affordable new car. Not a flashy financing deal on a heavy SUV or a “starting from” price that only refers to a stripped-down version that most people never see, but a real, simple, brand-new car that was priced within the reach of an average household. For the majority of people, that moment seems very far away and almost like a dream. It is not a coincidence. It reflects a real and continuing change in the American car market.

The concept of an entry-level new car is gradually disappearing from the daily world. What used to be a typical purchase for first-time buyers, young professionals, or families that need a safe means of transport has now become a very rare occurrence. Prices have been going up, the size of vehicles has increased, and the manufacturers have silently shifted their focus. This is not going on very fast, but the total effect is quite significant.

1. Firstly, New Car Prices Reflect a Different Reality

The mean price for purchasing a new car in the U.S. is now close to $49,814 and that number has completely changed the buyers’ expectations all over the market. The level is not a consequence of only a few months of a shortage or a spike that is caused by unusual conditions. The value for the price of a new car is the new standard that customers have to accept.

Prices have been increasing by more than one percent when compared with the previous year, and the experts expect even more significant price changes toward the end of the year. Normally, prices are at their highest in December, which means that the final numbers could be even greater. The market is behaving in such a way that there are no more cycles which bring the prices back to the old levels that people were used to.

For a large number of buyers, this results in the situation where the income growth and vehicle costs appear to be two completely different things. Salaries have not been increasing at the same rate as vehicle prices, which has led to the affordability gap becoming wider. A purchase that used to be considered manageable is now forcing long-term financial stretching.

2. What Did the Affordable Car Become?

The current state of affairs in car dealerships can tell us a lot about why car prices have gone up so much. There hardly can be any compact sedans or ordinary hatchbacks found on the floors of dealerships these days, the majority of buyers are now surrounded by cars that are purposely built to give the impression of being premium ones even though they are meant to be mainstream.

Consumers have placed their preference on (1) large pickup trucks, (2) high-end SUVs, and (3) cars loaded with optional features, which rapidly increase the price of the vehicle. These models are highly attractive to those with higher incomes who value comfort, technology, and the prestige that comes with the product.

Manufacturers have been eager to meet this demand from consumers. More advertising, more development investment, and more showroom space are given to the vehicles that bring higher profit margins. As a consequence, affordable models have been gradually replaced by the silent death through a lack of attention rather than by any dramatic announcement.

3. The Sales Data Gives the Clearest Picture of the Changes

Recent sales figures are quite decisive and thus do not allow for much interpretation. The market is quickly being drained of affordable new cars. Cars that are priced under $30,000 now make up only a very small fraction of the total new-car sales. In a report for November, that proportion was as low as 7.5 percent. The fall is not subtle and slow at all. It indicates a radical change in what consumers can realistically get. Affordability has ceased to be the standard.

What the Numbers Reveal:

- Sub-$30K cars becoming fewer

- Share at 7.5%

- Uninterrupted year-over-year decrease

- Less availability of budget options

- Market trending towards the upscale segment

It becomes much easier to see the difference when you compare it with previous periods. Only one year ago the proportion of new vehicles priced below $30,000 was over ten percent. If you take a step back to 2019, then you will find out that almost 38 percent of the cars that were sold were in the price range of $30,000 or less. At present time, less than one out of every ten buyers is able to get a new car at that level. This is not a gradual change. It is a rapid contraction. The data shows how fast affordability has slipped away from the reach of many households.

4. The Top-End Market Is Growing

While the choice of affordable cars is getting smaller, the interest in expensive vehicles is increasing. Over ten percent of all new vehicles sold are more expensive than $75,000. These models are no longer the rarities that are only to be found in luxury showrooms.

This change lowers or raises the average price of the whole industry. Even if the segments with lower-priced vehicles remain unchanged, the overall average is pushed higher by the increasing proportion of luxury vehicles. The end result is a market that seems to be more and more out of touch with everyday people’s financial situations.

Those affordable models which are still available should be considered as the exceptions. Their existence shows how far budget-friendly new cars have disappeared.

5. Trucks and Their Outsized Influence

One of the main reasons behind the increase in car prices has been the rise of Full-size pickup trucks. These models have been the main contributors to holding the average transaction prices above $70,000 for the past several months. The demand has been the main driver of the values remaining high even though other segments are trying to stabilise. Trucks are not the small or utility-focused works anymore that some people thought of them. Instead, they are at the centre of the market. Their high pricing gives them a significant role in industry trends and that is why they cannot be overlooked.

Why Trucks Influence the Prices:

- Prices over $70K

- Strong buyer demand

- High transaction values

- Large sales volumes

- Market-wide influence

Their effect can be better understood if we consider their sales volume. In the month of November only, more than 14 percent of all new vehicle sales were of pickup trucks, that is about 183,000 units were sold. The high price and high volume combination that trucks have is what gives them a more significant role in terms of industry averages than what the other vehicles do. Even if the smaller vehicles stop getting more expensive trucks will still keep the overall prices at a high level. The reason that their popularity alone is enough to move the entire market upwards is that trucks are still the most dominant ones. Until the time that trucks will cease to be dominant, affordability will still be at risk.

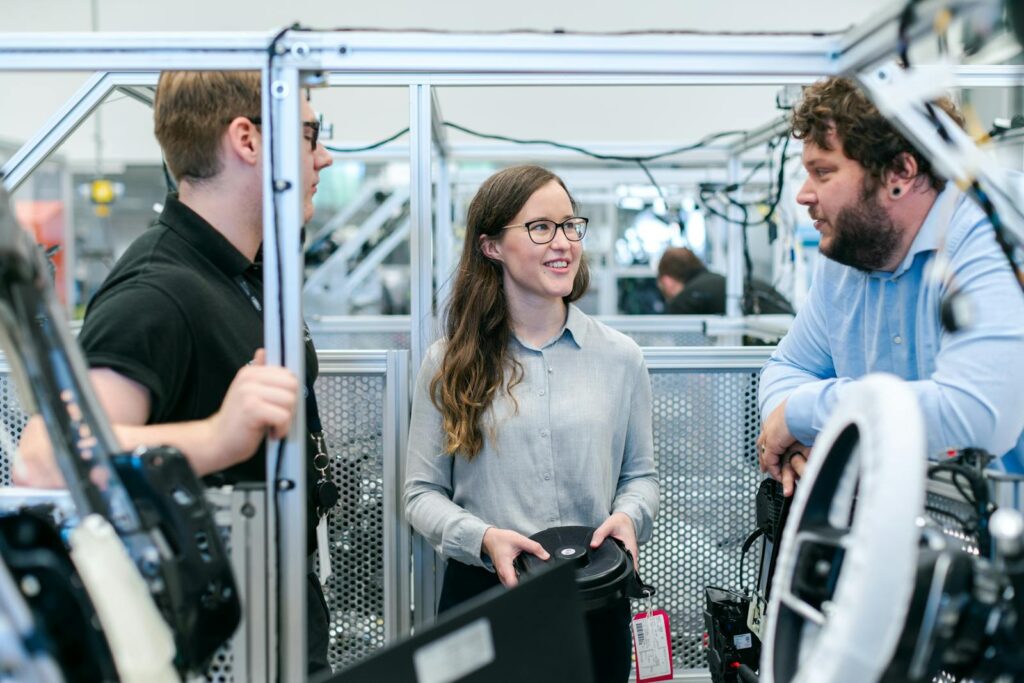

6. Why Automakers Prefer Bigger Vehicles

Essentially, at the heart of this change is a very simple business decision. Automakers, being profit-oriented companies, are making much more money from bigger, feature-packed cars than from the basic small models of the economy class.

In fact, just one fully loaded SUV can bring in more profit than several entry-level models combined. Therefore, from a corporate point of view, there is a significant difference that makes budget cars less attractive. As a result, over the period of time, the flow of capital is directed towards those products that yield more financial returns.

This is the reason why large companies have slowly moved their focus away from the production of entry-level cars. Car manufacturers have allocated their development resources, advertising budgets, and production capacity to the vehicles that can bring them stable profits, thus leaving economy cars with minimal support in the long run.

7. Incentives Are No Longer Doing the Heavy Lifting

At one point, discounts and incentives were one of the main factors that facilitated access to new cars. Now, these benefits have considerably reduced in volume. Last November, the average value of incentives was only 6.7 percent of transaction prices, compared to nearly 8 percent a year earlier.

Manufacturers have stopped using aggressive discount strategies simply because the buyers are very much willing to select higher trims that come loaded with technology and comfort features. Glass roofs, state-of-the-art displays, luxury interiors, and driver-assistance systems are becoming more and more the standard rather than the exception.

However, if there is still a robust demand for these types of specifications, then it is quite unlikely that deep incentives will be offered as they were in the past.

8. Rising Costs Beyond Consumer Demand

The trend towards luxurious and expensive cars cannot be simply separated from other factors. The price of making a vehicle has skyrocketed due to a mix of reasons such as (1) supply chain disruptions, (2) increased labor costs, and (3) raised prices for raw materials such as steel, aluminium, and lithium.

These factors have an impact on all vehicle segments. Instead of absorbing the costs, the manufacturers have for the most part handed them over to the buyers. In such a situation, it becomes almost impossible to provide genuinely affordable vehicles, even if there is consumer demand for them.

This has resulted in a market where the minimum prices are generally higher than before, and thus there is less room for the people with lower incomes to make financial choices within the price range.

9. Regulation, Safety, and the Cost of Progress

The modern automobile industry is influenced by a growing number of rules and regulations. Safety, emissions, and technology standards are now the main factors that decide almost every design element. To give a few examples, the safety cameras and tyre pressure monitoring systems, which were previously optional, are now compulsory. Such requirements raise the minimum standard for all cars. Although these requirements strengthen protection and reliability, they add further layers of complexity. The simple, low-cost vehicles of the past are gone.

Mandated Safety Additions:

- Backup cameras required

- Tyre pressure monitoring

- Emissions compliance

- Pedestrian safety focus

- Advanced driver systems

The industry also faces increasing pressure to ensure the safety of people outside the vehicle. Pedestrian safety regulations have been the main factors to have expedited the adoption of advanced driver-assistance systems. Consequently, automatic emergency braking and sensor technologies are nowadays standard features even in the most basic models. Without any doubt, these developments are instrumental in preventing accidents and thus saving lives. However, they are not without a price. Every additional system means higher manufacturing costs. Finding the balance between keeping products affordable and making progress has become one of the greatest challenges of the industry.

10. What This Means for Everyday Buyers

The fading away of affordable new cars is not just about statistics and graphs. It also means deeply different lifestyle choices for families, first-time buyers, and people with low income. The process of buying one’s first vehicle or changing an old car has become quite difficult.

Many buyers are faced with a very limited range of options: either they stretch their finances to buy a new car which is more than what they actually need, or they go for an increasingly expensive used market which has limited inventory and is full of uncertainty. This situation can cause the gap in mobility between those who can afford new cars and those who cannot get even wider.

The trend of the market is very obvious. New affordable cars are turning into a thing of the past, not because people no longer need them, but because economic forces and industry priorities have led to the different sectors. The dream of having a basic but reliable new car seems to be drifting farther away from the reach of many Americans as the prices are still going up.